Tailored Solutions

Customized financial offerings designed to meet the specific needs of micro, small, and medium enterprises.

We offer reliable, tailored loan solutions to support the growth and sustainability of MSME businesses.

Customized financial offerings designed to meet the specific needs of micro, small, and medium enterprises.

We collaborate with reputed lenders to ensure smooth, transparent, and secure loan processing experiences.

We support city-based MSMEs with quick funding to expand operations and boost market presence.

Helping rural entrepreneurs access credit for sustainable growth, employment, and local economic development.

Providing young businesses with flexible financing options to scale confidently from idea to execution.

We offer customized loans to MSMEs in manufacturing for equipment, expansion, and production efficiency.

Perfect for families or individuals needing multiple loans Apply Now

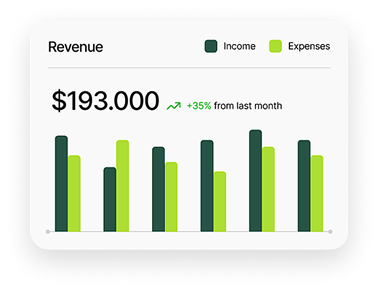

Quick loan approvals with minimal paperwork to help MSMEs stay focused on business growth.

Choose from various EMI options that align with your cash flow and business cycle.

Competitive interest rates to reduce financial burden and support long-term profitability.

Finance your working capital, machinery, or infrastructure needs without disrupting operations.

Loan amounts vary based on business profile, turnover, credit score, and lender policies.

Micro, small, and medium enterprises registered under MSME/Udyam can apply with valid business documentation.

PAN, GST certificate, business proof, bank statements, and financial reports are typically needed.

Our customer care team is available 7 days a week, 24*7 to assist you with the best offers or help resolve any queries.